ANNUAL REPORT 2015

LETTER TO

SHAREHOLDERS

Dear Shareholders,

A

lthough FY 2015 was not

as tumultuous as the Asian

Financial Crisis and Global

Financial Crisis, it was nevertheless

a challenging year for the Group.

The ripple effect of the deceleration

of China’s rampant economic

growth impacted strongly on

Asia and around the globe.

Free-falling

commodity

prices

continued to dampen resource-

based economies. This resulted in

weakening local currencies vis-à-vis

the Singapore Dollar (“SGD”).

The above challenging conditions

dampened our growth in FY2015

resulting in a Group total turnover

increase of 0.7% reaching SGD 292.5

million as compared to SGD 290.6

million in FY2014. A higher increase

in Group total turnover would have

been reported had it not been

for the marked weakening of the

Malaysian Ringgit, South African

Rand, Indonesian Rupiah and

Australian Dollar against the SGD

as overseas sales in local currencies

are converted and consolidated in

SGD.

Gross profit for the Group was

lower at $64.5 million in FY2015

as compared to $66.2 million in

FY2014 due to the aforementioned

challenges. As a result, gross profit

margin for FY2015 was slightly lower

at 22.1% as compared to 22.8% in

FY2014 with net profit for FY2015 at

$1.7 million.

We were however able to reduce

operating expenses by 1.9% to

$62.0 million in FY2015 compared

to $63.2 million in FY2014 due

to lower allowance for doubtful

debts, allowance for inventory

obsolescence and rental expenses

offset by higher depreciation,

salaries and marketing costs.

BUSINESS PROSPECTS

Looking ahead, the Group will focus

on its core business of distribution

in the South East Asia region, where

the bulk of our distribution centres

and our wheel factory are based.

We will continue to grow our network

of dealers which currently stands at

approximately 7,000.

South East Asia remains the

Group’s core region, contributing

about 83% of total Group revenue

while manufacturing of wheels

accounted for 13%. Though

economic conditions remain

challenging, there are still

opportunities which can be tapped

on for the Group’s long term growth.

Stamford Tyres will continue to:

• Expand our dealers network,

particularly in the South East Asia

region

• Widen product range and

offerings

• Focus on our value-added

services at our retail chain and

truck tyre centres

• Expandour total tyremanagement

services for our commercial fleet

and earthmover market segments

We will also continue to work with our

principals to improve both product

and pricing support to counter the

competition we are facing in some

markets. As a result of our long-term

partnership with Sumitomo Group,

today, we hold the distribution rights

to Falken Tyres in selected territories

in South East Asia, Indian Ocean,

Pacific Ocean and Africa which

will be expanded upon as well as

tapped-on to harness the massive

potential in our joint venture in India.

In addition to our distribution

centres, our export network for

proprietary brands – Sumo Tyres,

Sumo Firenza and SSW wheels -

spans over 90 countries including

Eastern and Western Europe, Africa,

Latin America and the Middle East.

This allows us to optimise global

opportunities and minimise the

impact of any downturn in any one

particular region in the world.

2

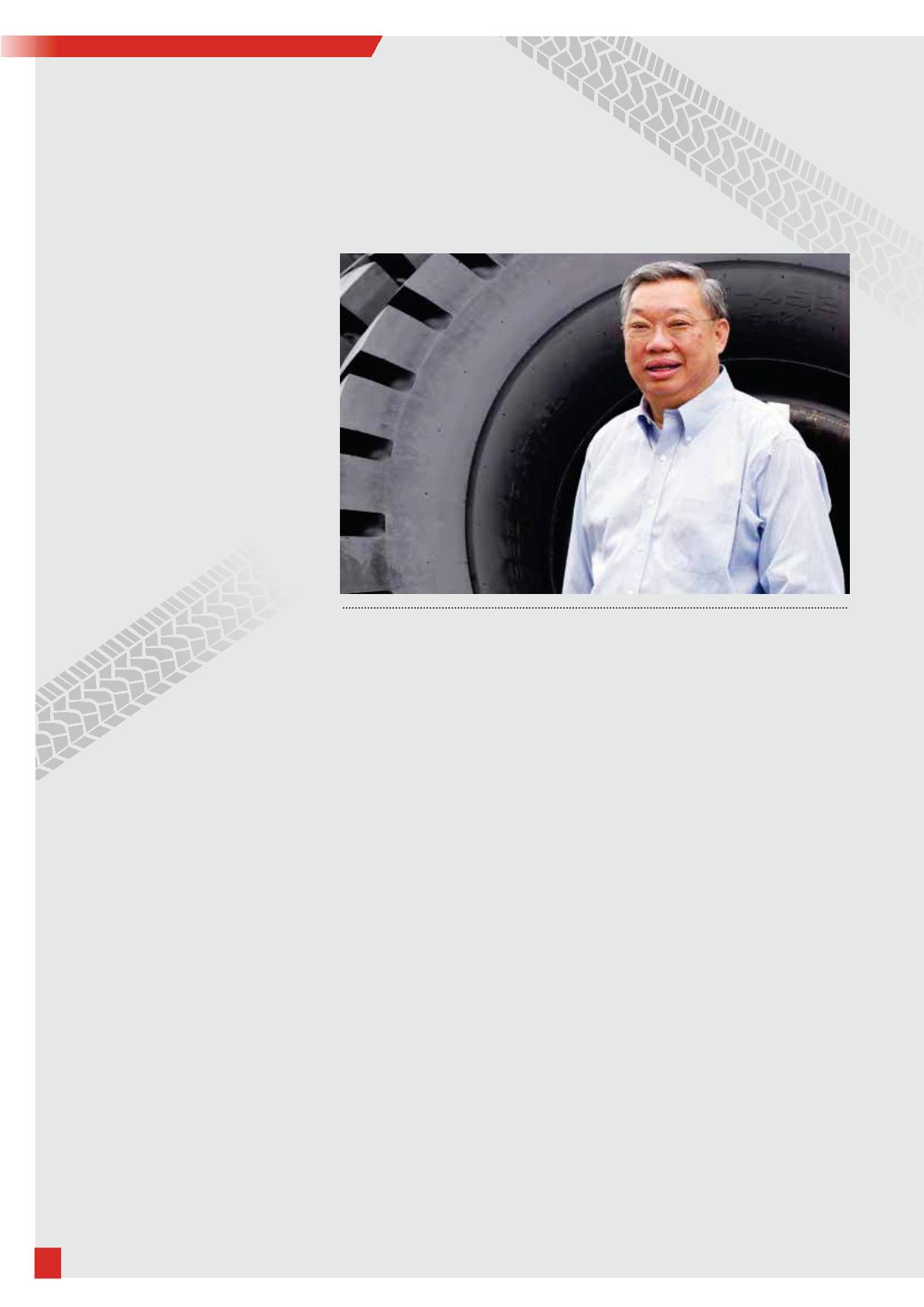

Stamford Tyres

prides itself as

one of the largest

tyres and wheels

distributors in

the region and

we will continue

“Building on

Our Extensive

Network”

BUILDING ON OUR EXTENSIVE NETWORK