Financial Statements And Related Announcement - Half Year Results

Financials Archive![]() Note: Files are in Adobe (PDF) format.

Note: Files are in Adobe (PDF) format.

Please download the free Adobe Acrobat Reader to view these documents.

Condensed Interim Financial Statements for 6 Months Financial Period Ended 31 October 2024

Condensed interim consolidated income statement

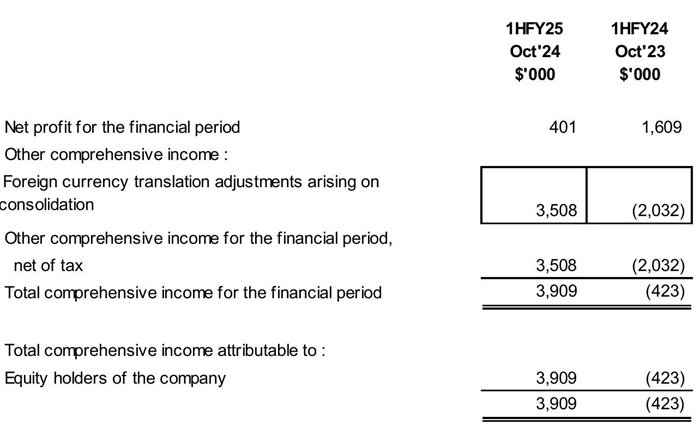

Condensed interim consolidated statement of comprehensive income

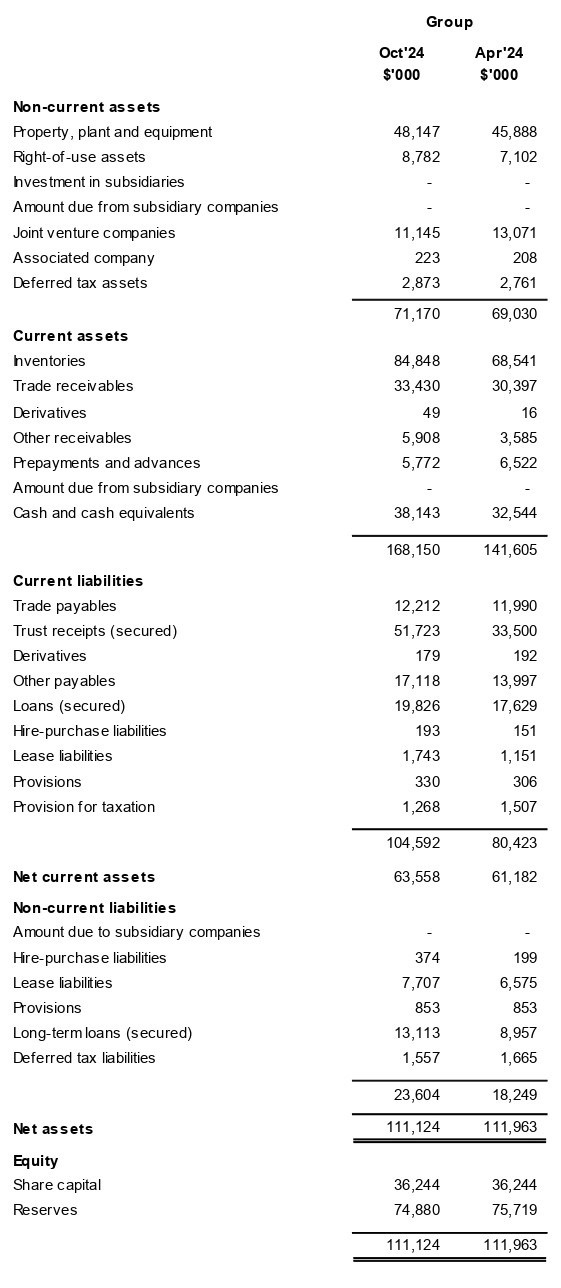

Condensed interim statements of financial position

Review of Performance

1HFY25

Revenue

The Group's sales revenue was 1.2% lower at S$94.5 million in 1HFY25 compared to S$95.6 million in 1HFY24, primarily due to lower sales in the South East Asia markets.

Gross Profit and Gross Profit Margin

Gross profit dollar decreased by S$0.6 million to S$23.9 million in 1HFY25 compared to S$24.5 million in 1HFY24. The decrease was mainly due to lower sales.

Gross profit margin was relatively flat at 25.3% in 1HFY25 compared to 25.6% 1HFY24.

Operating Expenses

Total operating expenses increased by 3.9% to S$26.0 million in 1HFY25 compared to S$25.1 million in 1HFY24. The increase was mainly due to higher staff cost, lease expenses and other operating expenses; offset by lower marketing and distribution cost, finance cost and utilities, repair and maintenance cost.

Other operating expenses was higher in 1HFY25 mainly due to lower write-back of provision (1HFY24 S$1.6 million compared with 1HFY24 S$0.2 million) for inventory obsolescence from the sale of slow moving stocks previously provided for.

Share of Results of Joint Ventures

In 1HFY25, the share of results from joint ventures amounted to a net profit of S$221,000, comparable to S$220,000 in 1HFY24.

Net Profit

The net profit of the Group was S$0.4 million in 1HFY25, compared to S$1.6 million recorded in 1HFY24.

Financial Position

Property, plant and equipment increased to S$48.1 million as at 31 October 2024 from S$45.9 million as at 30 April 2024 mainly due to acquisition of new properties in Indonesia.

Receivables increased to S$33.4 million as at 31 October 2024 from S$30.4 million as at 30 April 2024.

Inventories increased to S$84.8 million as at 31 October 2024 from S$68.5 million as at 30 April 2024.

Trade payables and trust receipts increased to S$63.9 million as at 31 October 2024 from S$45.5 million as at 30 April 2024.

As at 31 October 2024, the Group's cash and cash equivalents stood at S$38.1 million compared to S$32.5 million as at 30 April 2024.

The Group's borrowings which comprise trust receipts, revolving credit, hire-purchase liabilities, short-term secured loans as well as long-term secured loans stood at S$85.2 million as at 31 October 2024 compared to S$60.4 million as at 30 April 2024. The increase in borrowings was mainly for inventory funding during the period.

Commentary

The operating environment in the tyre business remains challenging as a result of intense competition and major geo-political and macroeconomic events globally.

To mitigate the impact of this challenging environment, the Group will continue to optimize its product mix, manage operating costs and build on its core markets in South East Asia.