Notes to the Financial Statements

(Cont’d)

For the financial year ended 30 April 2016

(In Singapore Dollar)

ANNUAL REPORT 2016

DRIVING IT UP

| 107

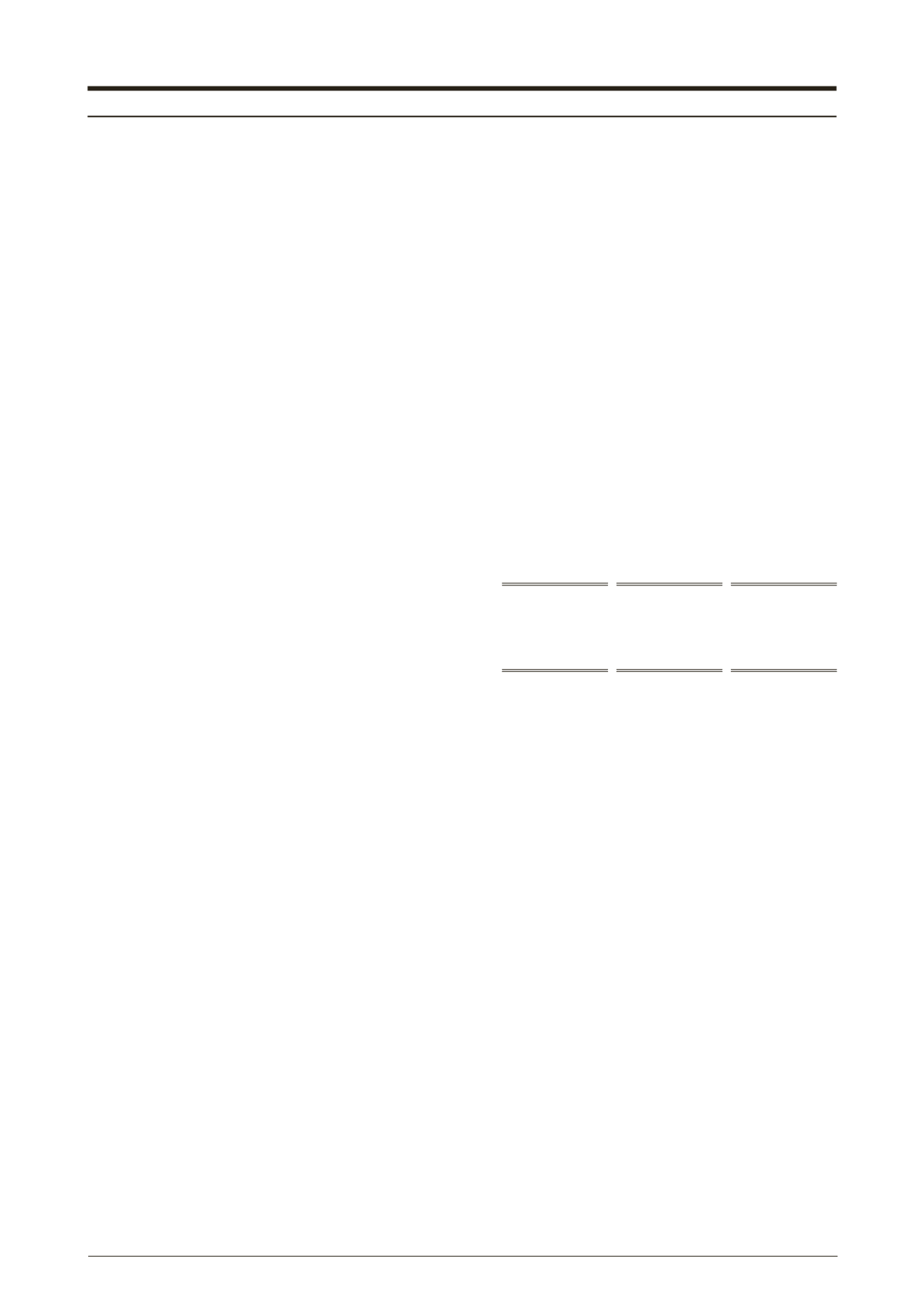

37.

Fair value of financial instruments (cont’d)

(a)

Fair value of financial instruments that are carried at fair value (cont’d)

Note

Quoted prices

in active

markets for

identical

instruments

(Level 1)

Significant

other

observable

inputs

(Level 2)

Significant

unobservable

inputs

(Level 3)

$’000

$’000

$’000

Company

2016

Financial liabilities

Forward currency contracts

18

–

(39)

–

2015

Financial liabilities

Forward currency contracts

18

–

(3)

–

Fair value hierarchy

The Group classify fair value measurement using a fair value hierarchy that reflects the significance

of the inputs used in making the measurements. The fair value hierarchy have the following levels:

l

Level 1

– Quoted prices (unadjusted) in active markets for identical assets or liabilities

l

Level 2

– Inputs other than quoted prices included within Level 1 that are observable

for the asset or liability, either directly (i.e., as prices) or indirectly (i.e., derived

from prices), and

l

Level 3

– Inputs for the asset or liability that are not based on observable market data

(unobservable inputs)

Determination of fair value

Forward currency contracts and interest rate swaps are valued using a valuation technique with

market observable inputs. The most frequently applied valuation techniques include forward pricing

and swap models, using present value calculations. The models incorporate various inputs including

the foreign exchange spot and forward rates, interest rate curves and forward rate curves.