Notes to the Financial Statements

(Cont’d)

For the financial year ended 30 April 2016

(In Singapore Dollar)

ANNUAL REPORT 2016

DRIVING IT UP

| 109

38.

Capital management (cont’d)

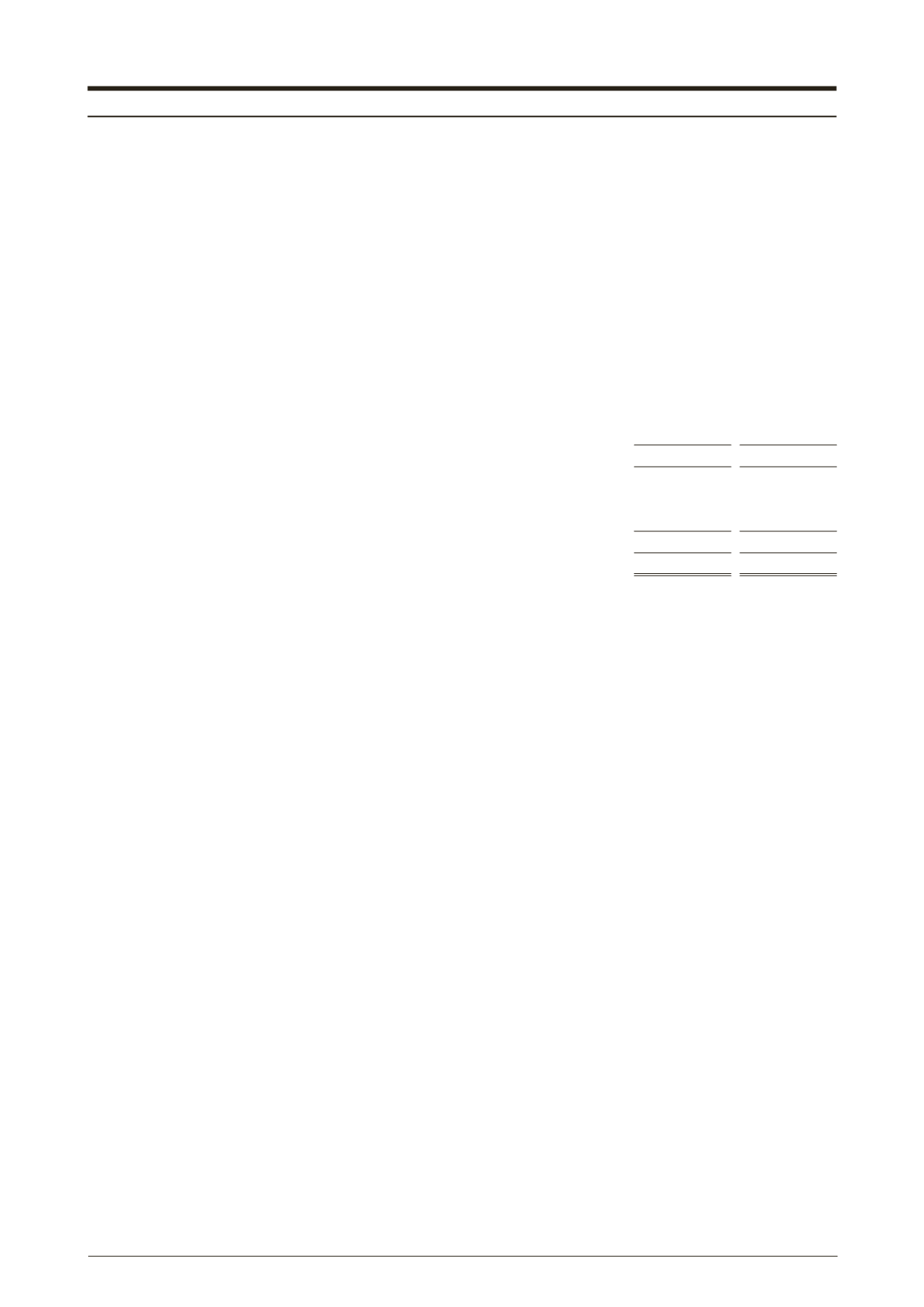

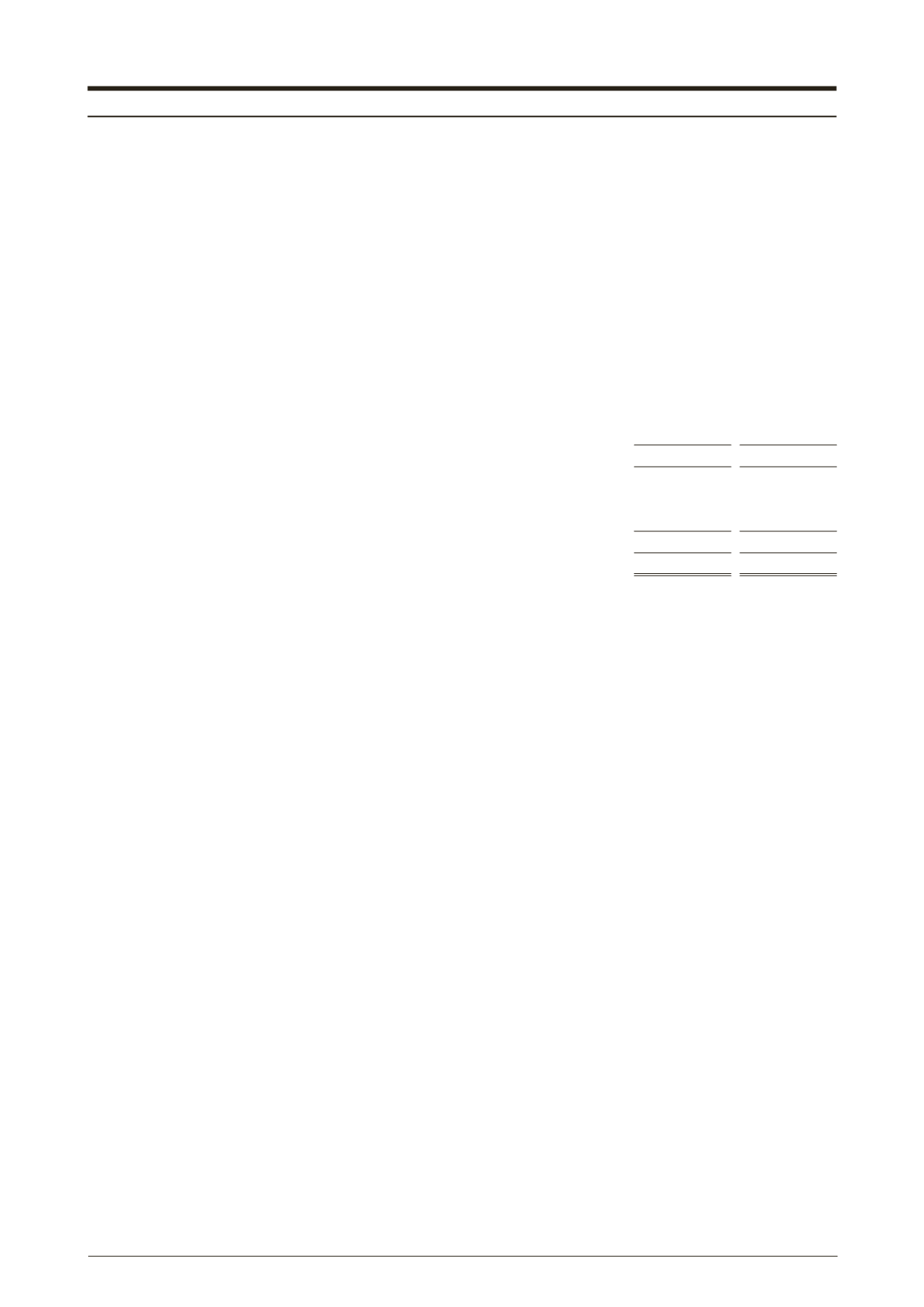

Group

2016

2015

$’000

$’000

Trust receipts

49,686

70,641

Loans (secured)

57,636

56,904

Bank borrowings

107,322

127,545

Equity attributable to the equity holders of the Company

117,505

121,034

Less: Statutory reserve fund

(424)

(424)

Distributable net assets

117,081

120,610

Gearing ratio (times)

0.92

1.06

The Company and certain subsidiaries of the Group are subject to financial covenants for credit facilities

provided by banks. The Company and these subsidiaries are required to maintain certain leverage ratios,

debt service coverage ratios, interest coverage and shareholders’ funds.

As disclosed in Note 30, a subsidiary of the Group is required to maintain a five percent reserve at each

distribution of dividends until the reserve reaches at least ten percent of the subsidiary’s authorised capital.

This externally imposed capital requirement has been complied with by the subsidiary for the financial

years dated 30 April 2016 and 30 April 2015.

39.

Segment information

For management purposes, the Group is organised into business units based on their geographical

locations, and has four reportable segments as follows:

I.

South East Asia

II.

North Asia

III.

Africa

IV.

Others

Distribution of tyres and wheels to external customers are included in the South East Asia, North Asia,

Africa and other segments. Manufacturing of alloy wheels sold directly to external customers are included

in the South East Asia segment.

Except as indicated above, no operating segments have been aggregated to form the above reportable

operating segments. Management monitors the operating results of its business units separately for

the purpose of making decisions about resource allocation and performance assessment. Segment

performance is evaluated based on operating profit or loss which in certain respects, as explained in the

table below, is measured differently from operating profit or loss in the consolidated financial statements.

Income taxes are managed on a group basis and are not allocated to operating segments.