Notes to the Financial Statements

(Cont’d)

For the year ended 30 April 2015

(In Singapore Dollars)

67

STAMFORD TYRES CORPORATION LIMITED

BUILDING ON OUR EXTENSIVE NETWORK

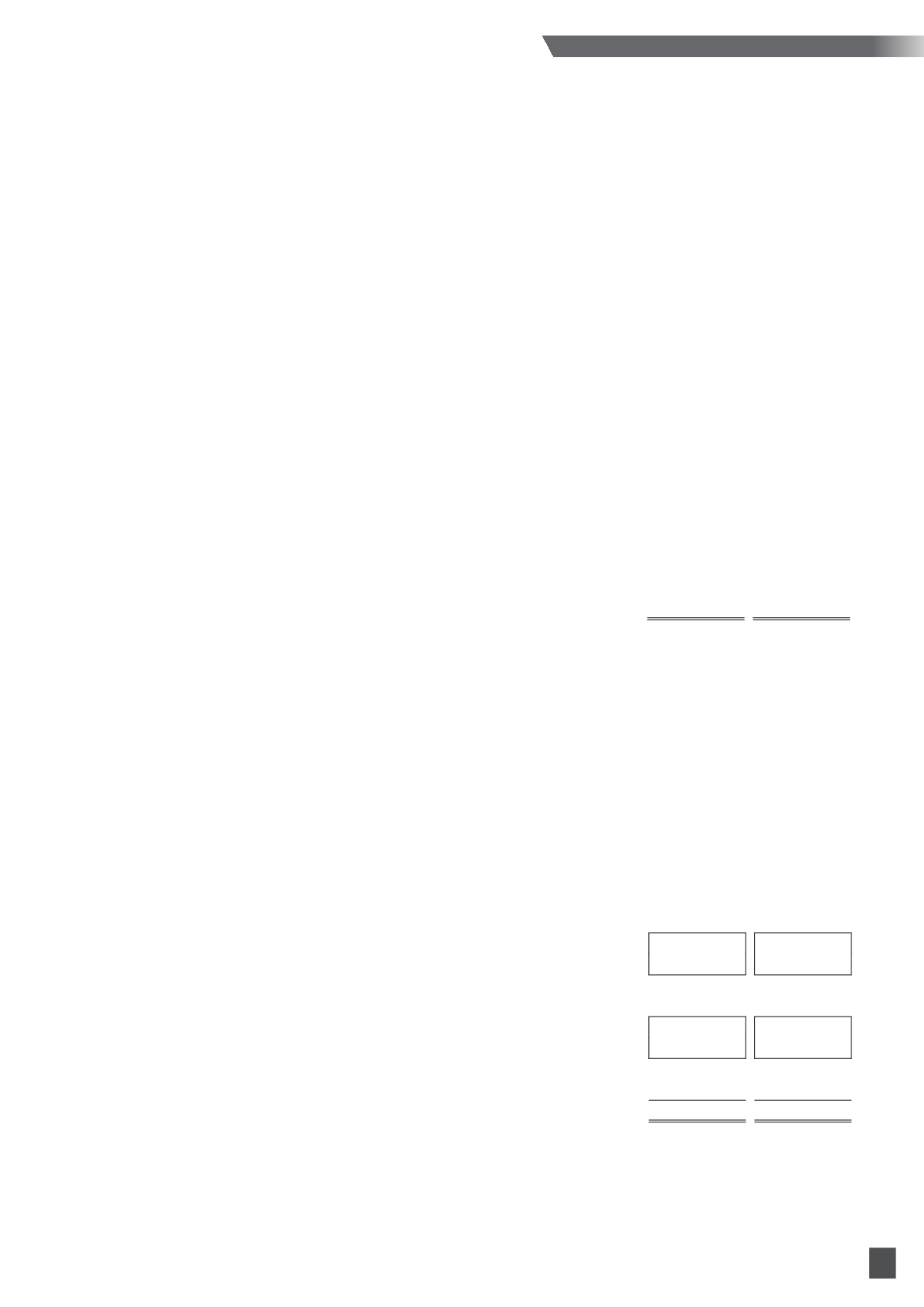

9.

Profit before taxation

Profit before taxation is stated after charging/(crediting):

Group

2015

2014

$’000

$’000

Depreciation of property, plant and equipment (inclusive of charges

included in costs of goods sold)

9,033

7,389

Foreign exchange loss

2,368

3,509

(Write-back of)/allowance for inventory obsolescence

(138)

1,443

Fair value (gain)/loss on other financial instruments

(440)

177

Gain on disposal of property, plant and equipment

(124)

(5,644)

Property, plant and equipment written-off

94

2

Bad debts written-off directly to profit or loss

125

54

Allowance for doubtful trade receivables

1,358

2,696

Compensation received in respect of exit from China

–

(1,551)

Audit fees:

- Auditors of the Company

470

456

- Other auditors

150

182

There are no non-audit fees paid to the auditors of the Company during the financial year.

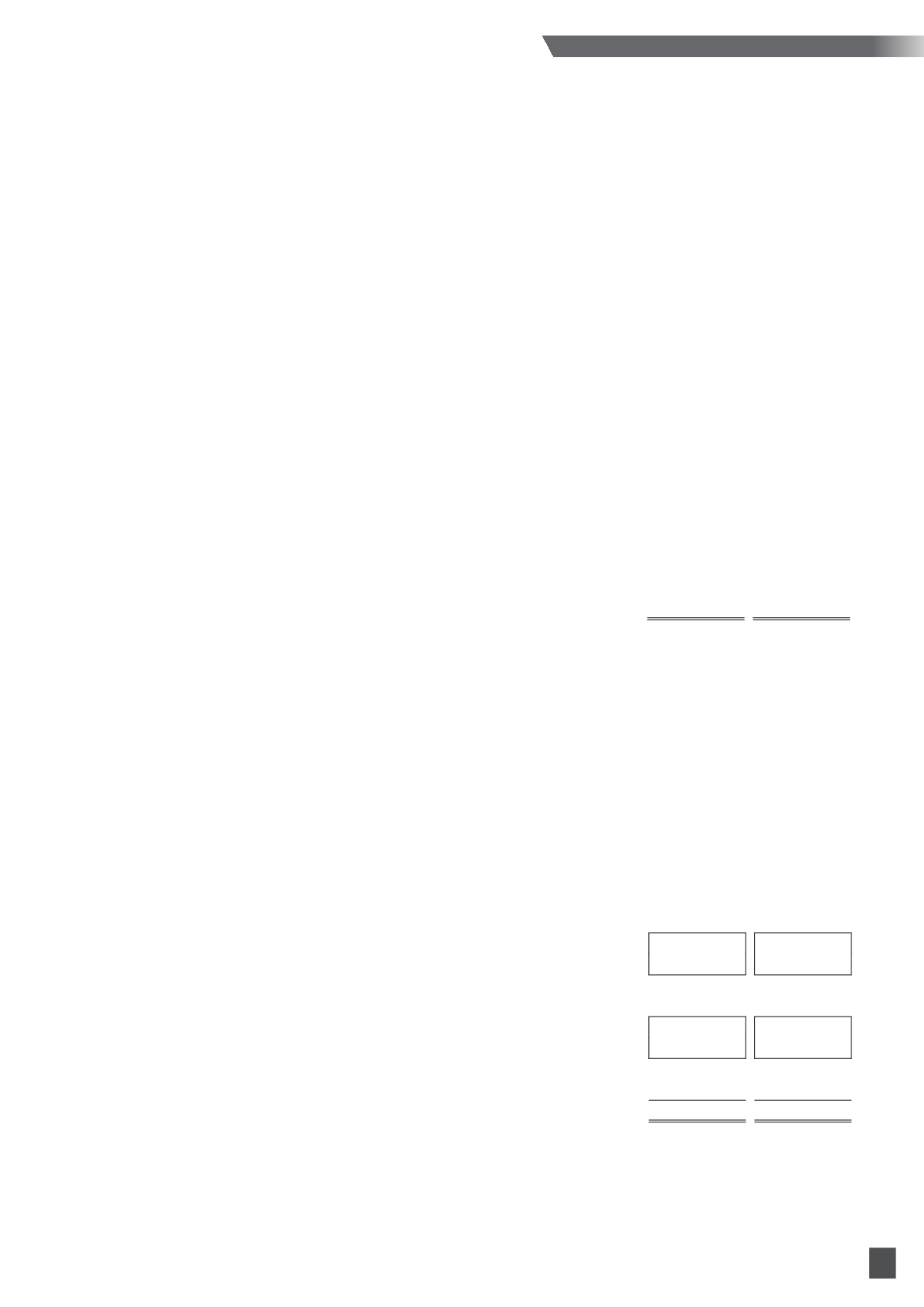

10. Taxation

Major components of income tax expense

The major components of income tax expense for the years ended 30 April 2015 and 2014 are:

Group

Note 2015

2014

$’000

$’000

Income statement

Current income taxation

- Current year

2,031

2,464

- (Over)/under-provision of tax in respect of prior years

(483)

47

1,548

2,511

Deferred income taxation

28

- Origination of temporary differences

(34)

220

- Write-back of deferred tax liabilities relating to plant and equipment

–

(2,174)

(34)

(1,954)

Withholding taxation

263

–

Income tax expenses recognised in profit or loss

1,777

557