Notes to the Financial Statements

(Cont’d)

For the year ended 30 April 2015

(In Singapore Dollars)

ANNUAL REPORT 2015

68

BUILDING ON OUR EXTENSIVE NETWORK

10. Taxation (cont’d)

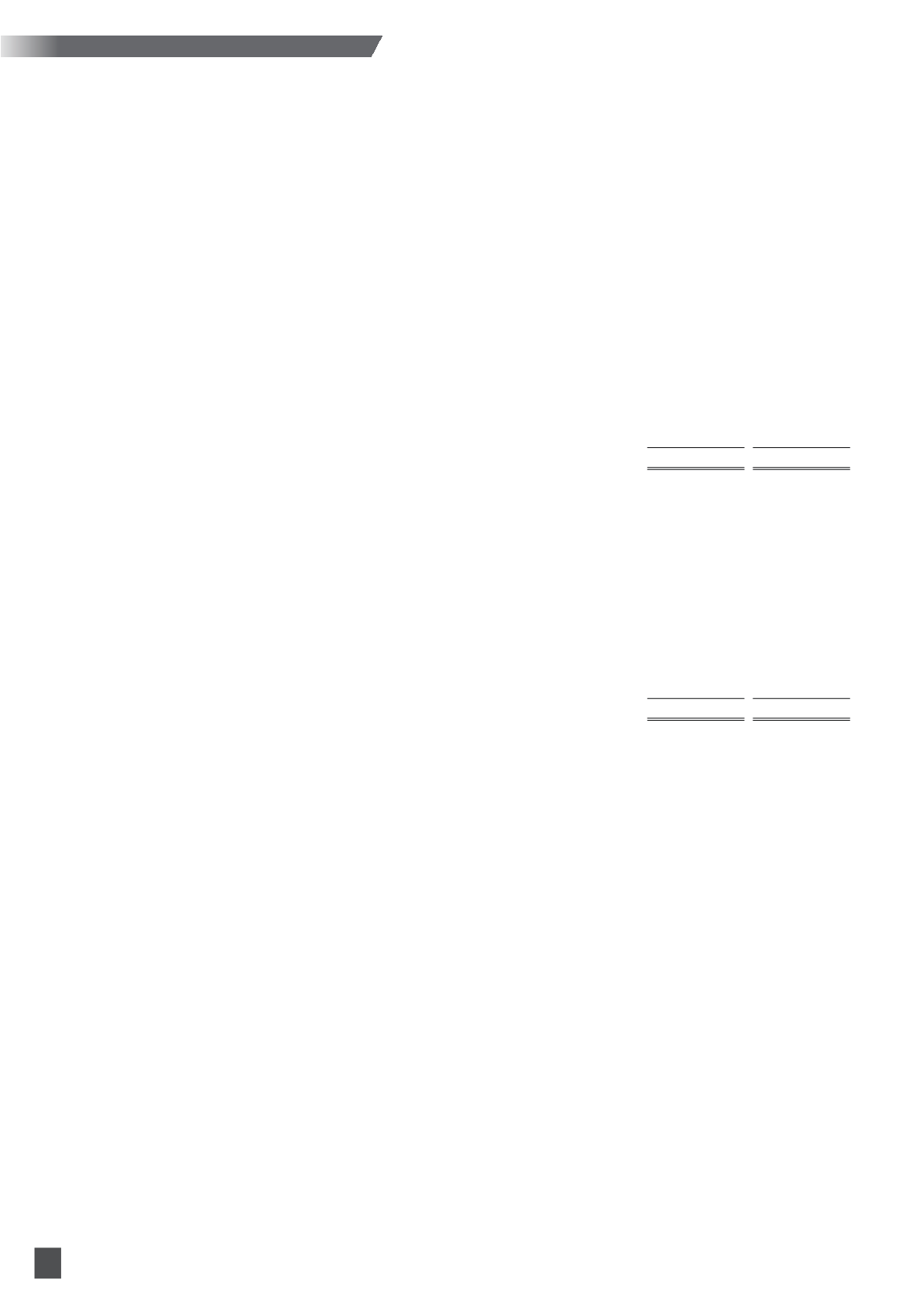

Relationship between tax expense and accounting profit

The reconciliation between tax expense and the product of accounting profit multiplied by the applicable

corporate tax rate for the years ended 30 April 2015 and 2014 are as follows:

Group

2015

2014

$’000

$’000

Profit before taxation

3,480

10,573

Less: Share of results of joint ventures*

(89)

718

3,391

11,291

Taxation at statutory tax rate of 17% (2014: 17%)

576

1,919

Adjustments:

- Expenses not deductible for income tax purposes

631

123

- Effects of different tax rates in other countries

(114)

93

- Deferred tax assets not recognised in the current year

972

654

- Partial tax exemption and tax relief

(52)

(52)

- Write-back of deferred tax liabilities in relation to plant and equipment

–

(2,174)

- Withholding tax

263

–

- Others

(16)

(53)

- (Over)/under-provision of tax in respect of prior years

(483)

47

Taxation

1,777

557

* These are presented net of tax in profit or loss.

As at 30 April 2015, the Group, primarily through its subsidiary companies, has unutilised tax losses of

approximately $22,021,000 (2014: $16,821,000) which may, subject to the agreement with the relevant tax

authorities, be carried forward and utilised to set-off against future taxable profits. Except for an amount

of $4,257,000 (2014: $3,286,000) which would expire in between 2016 and 2023 (2014: between 2015

and 2022), there is no time limit imposed on the utilisation of the remaining tax losses. The potential tax

benefit of approximately $6,331,000 (2014: $4,957,000) arising from the unutilised tax losses has not been

recognised in the financial statements due to the uncertainty of its recoverability.