Notes to the Financial Statements

(Cont’d)

For the year ended 30 April 2015

(In Singapore Dollars)

77

STAMFORD TYRES CORPORATION LIMITED

BUILDING ON OUR EXTENSIVE NETWORK

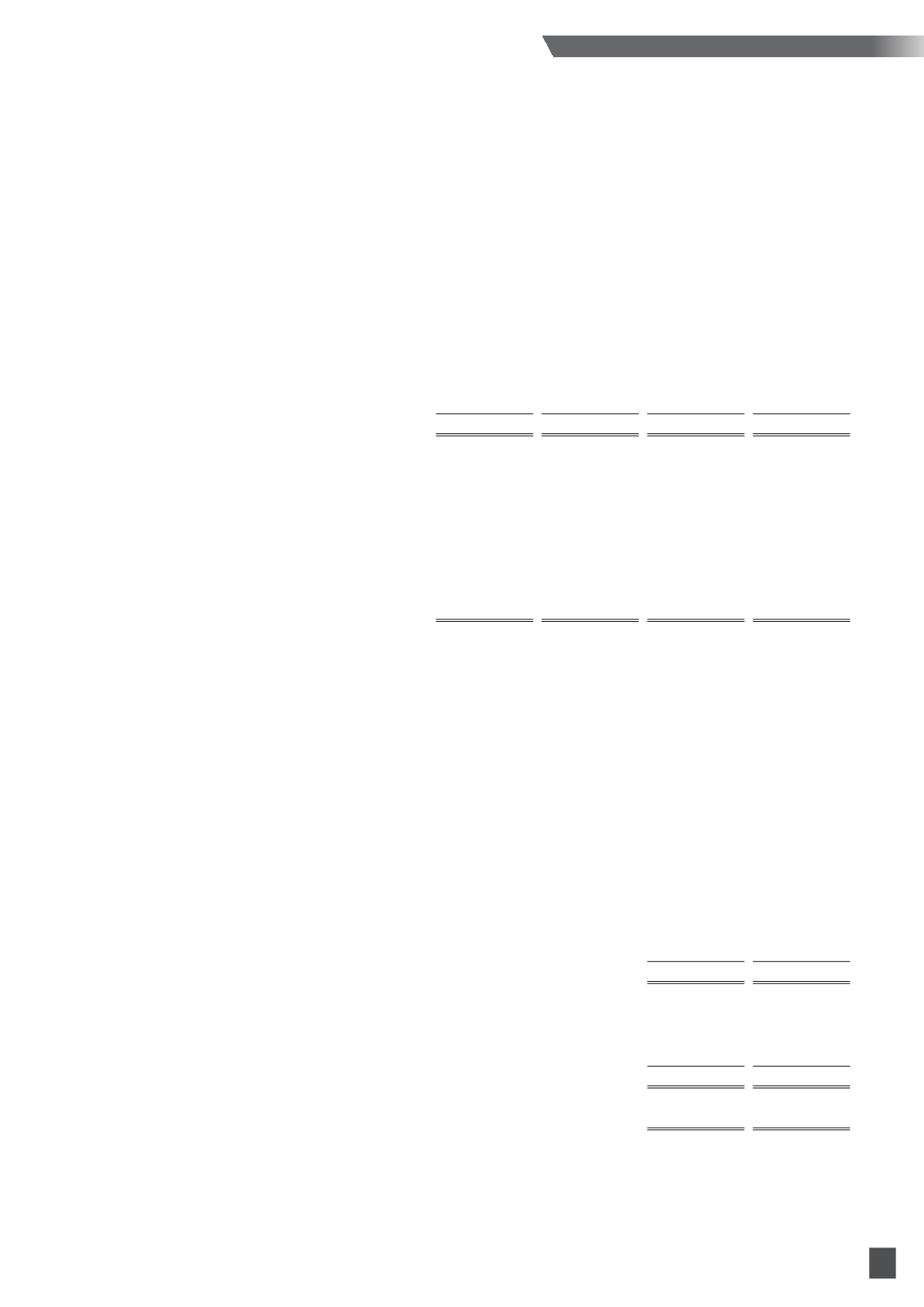

18. Derivatives

Group

Note

2015

Fair value

2014

Fair value

Assets

Liabilities

Assets

Liabilities

$’000

$’000

$’000

$’000

Non-hedging instrument

- Forward currency contracts

(a)

188

(51)

–

(207)

- Interest rate swap

(b)

41

(3)

–

(58)

229

(54)

–

(265)

Company

Note

2015

Fair value

2014

Fair value

Assets

Liabilities

Assets

Liabilities

$’000

$’000

$’000

$’000

Non-hedging instrument

- Forward currency contracts

(a)

–

(3)

–

(79)

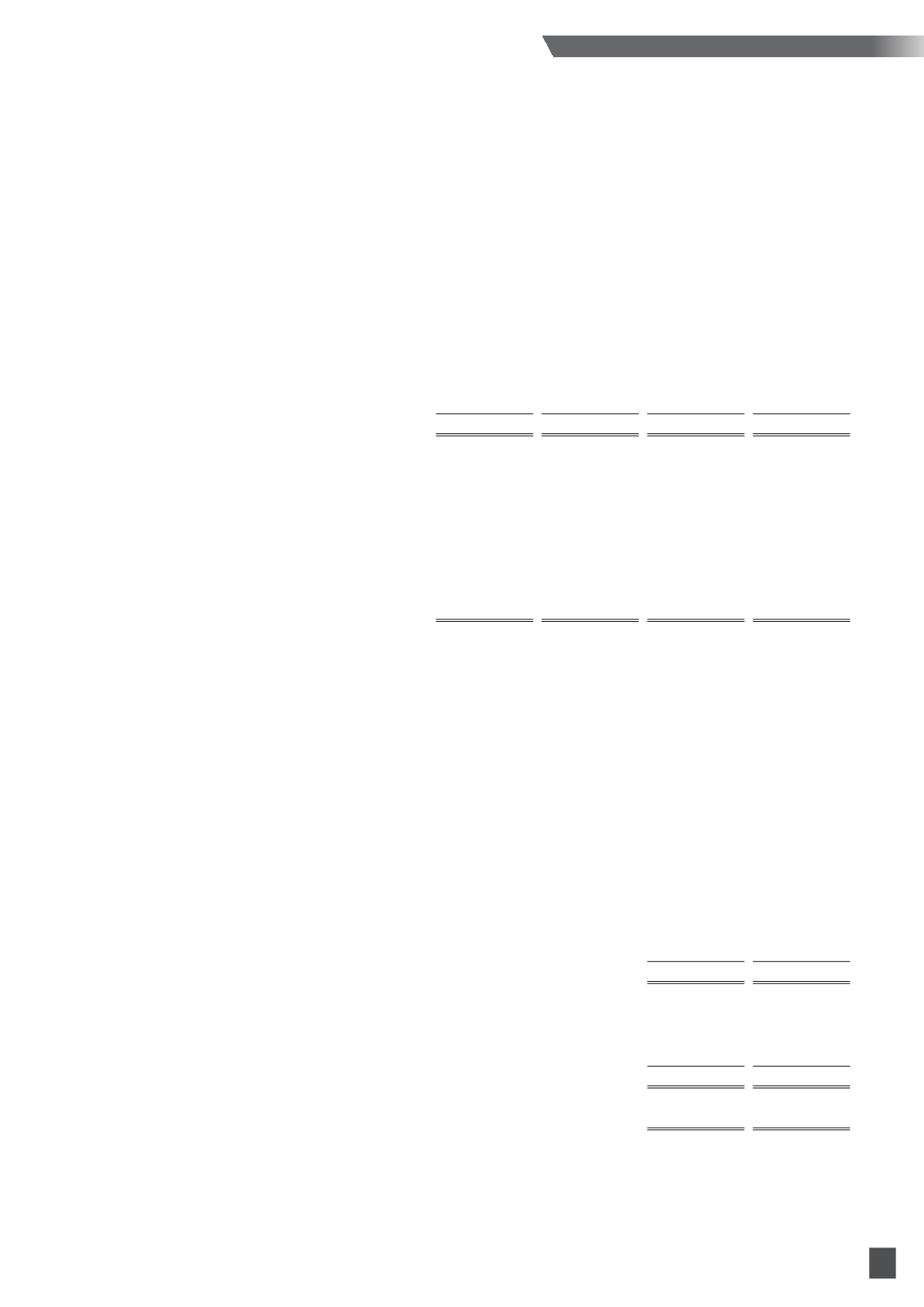

(a)

Foreign exchange forward contracts

The Group and the Company use foreign currency contracts to manage the risk against currency

fluctuations in connection with payments to overseas suppliers and receipts from overseas

customers and inter-company receivables and payables. The contractual amounts to be paid or

received and contractual exchange rates of the outstanding contracts at the end of each reporting

period are as follows:

Group

contractual/notional

amounts

2015

2014

$’000

$’000

To sell Singapore Dollars for:

- United States Dollars

3,322

1,979

- Euro

129

–

3,451

1,979

To sell South African Rand for

- Singapore Dollars

–

3,325

- United States Dollars

757

70

757

3,395

To sell Thai Baht for United States Dollars

256

514