Notes to the Financial Statements

(Cont’d)

For the year ended 30 April 2015

(In Singapore Dollars)

ANNUAL REPORT 2015

78

BUILDING ON OUR EXTENSIVE NETWORK

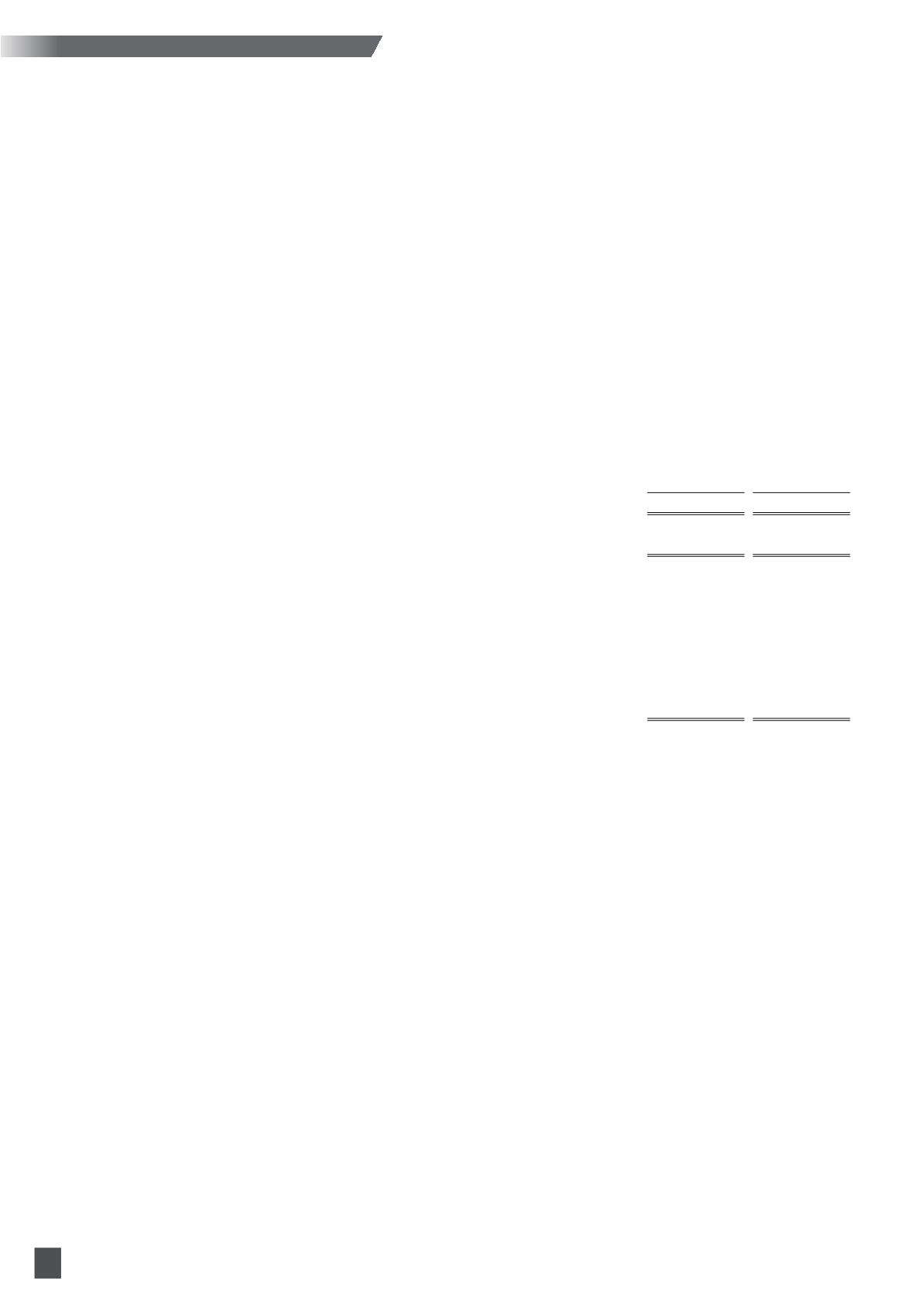

18. Derivatives (cont’d)

(a)

Foreign exchange forward contracts (cont’d)

Group

contractual/notional

amounts

2015

2014

$’000

$’000

To buy Singapore Dollars for:

- South African Rand

8,410

4,721

- United States Dollars

5,322

6,974

- Australian Dollars

2,937

1,844

- Euro

506

–

17,175

13,539

To buy Thai Baht for United States Dollars

4,750

3,542

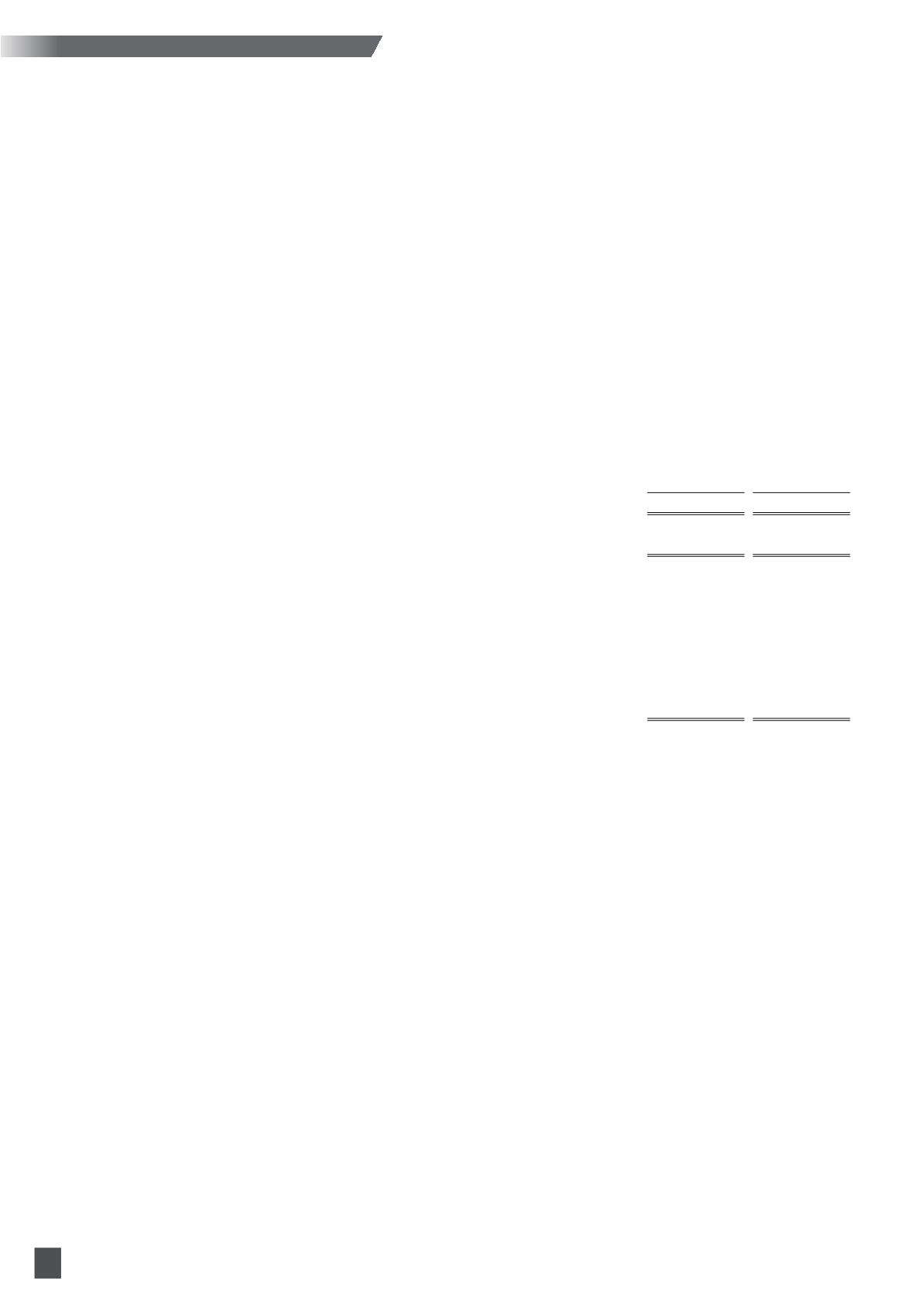

Company

contractual/notional

amounts

2015

2014

$’000

$’000

To buy Singapore Dollars for Australian Dollars

2,419

4,382

(b)

Interest rate swap

A subsidiary company entered into an interest rate swap of $12 million in 2012 to manage

its exposure to interest rate fluctuation. The interest rate swap pays floating rate interest equal to

3-month Swaps Offer Rate (“SOR”) and receives a fixed rate of interest of 0.90%. The interest rate

swap matures on 15 May 2015. The subsidiary company also entered into another interest rate swap

of $10 million in 2014 to manage its exposure to interest rate fluctuation. The interest rate swap pays

floating rate interest equal to 1-month Swap Offer Rate (“SOR”) and receives a fixed rate of interest of

0.99%.The interest rate swap matures on 6 June 2017.