Notes to the Financial Statements

(Cont’d)

For the year ended 30 April 2015

(In Singapore Dollars)

85

STAMFORD TYRES CORPORATION LIMITED

BUILDING ON OUR EXTENSIVE NETWORK

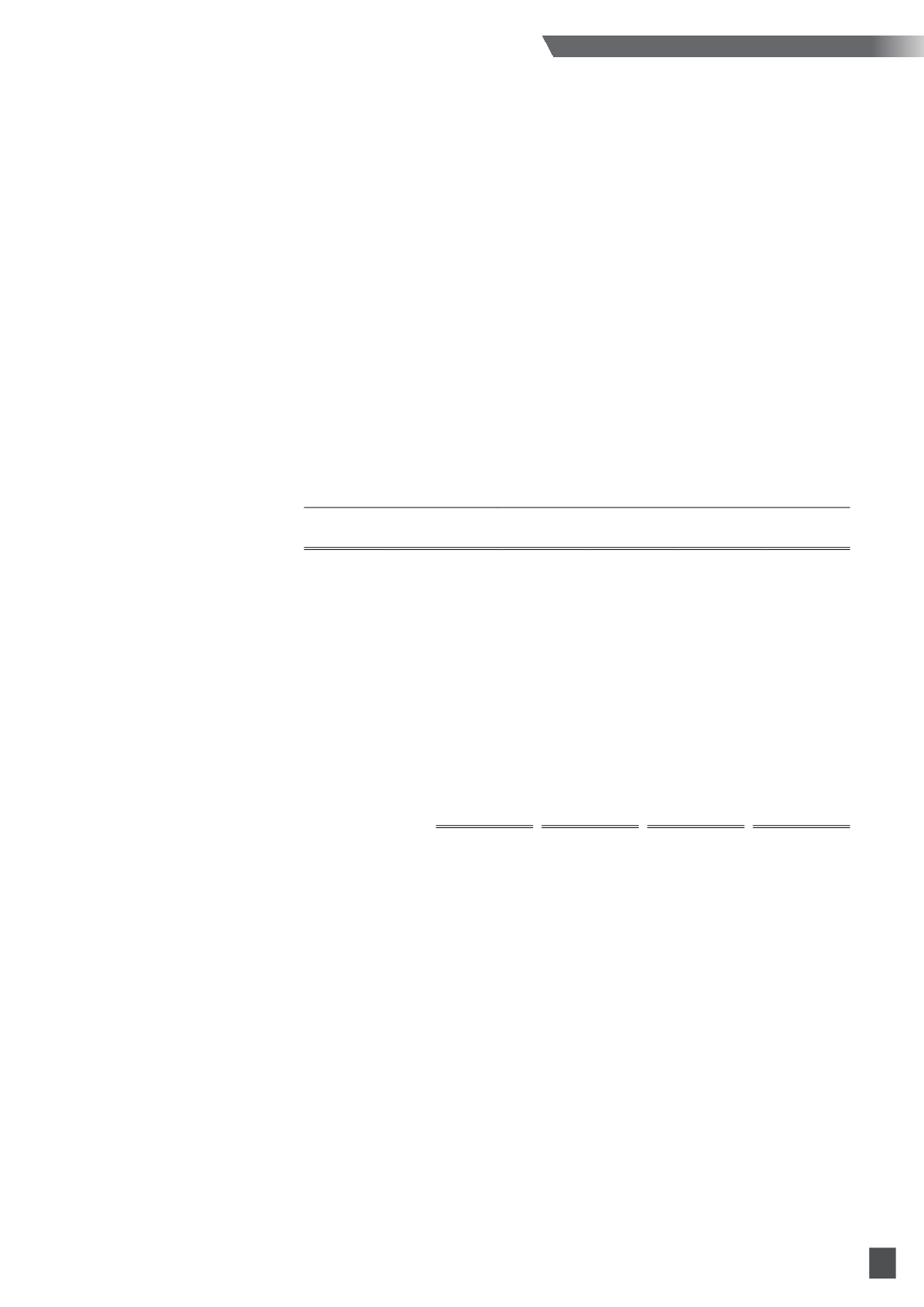

28. Deferred taxation (cont’d)

Group

2014

Property,

plant and

equipment Receivables Inventories

Unremitted

foreign

sourced

income

Provision,

accruals

and others Total

$’000

$’000

$’000

$’000

$’000

$’000

At beginning of the

financial year

2,395

(1,005)

(1,658)

108

66

(94)

Movement for the year

(1,718)

207

(201)

–

(242)

(1,954)

Foreign currency

translation adjustment

77

112

(78)

–

49

160

At the end of the

financial year

754

(686)

(1,937)

108

(127)

(1,888)

The deferred tax liabilities of the Company relate to unremitted foreign sourced income.

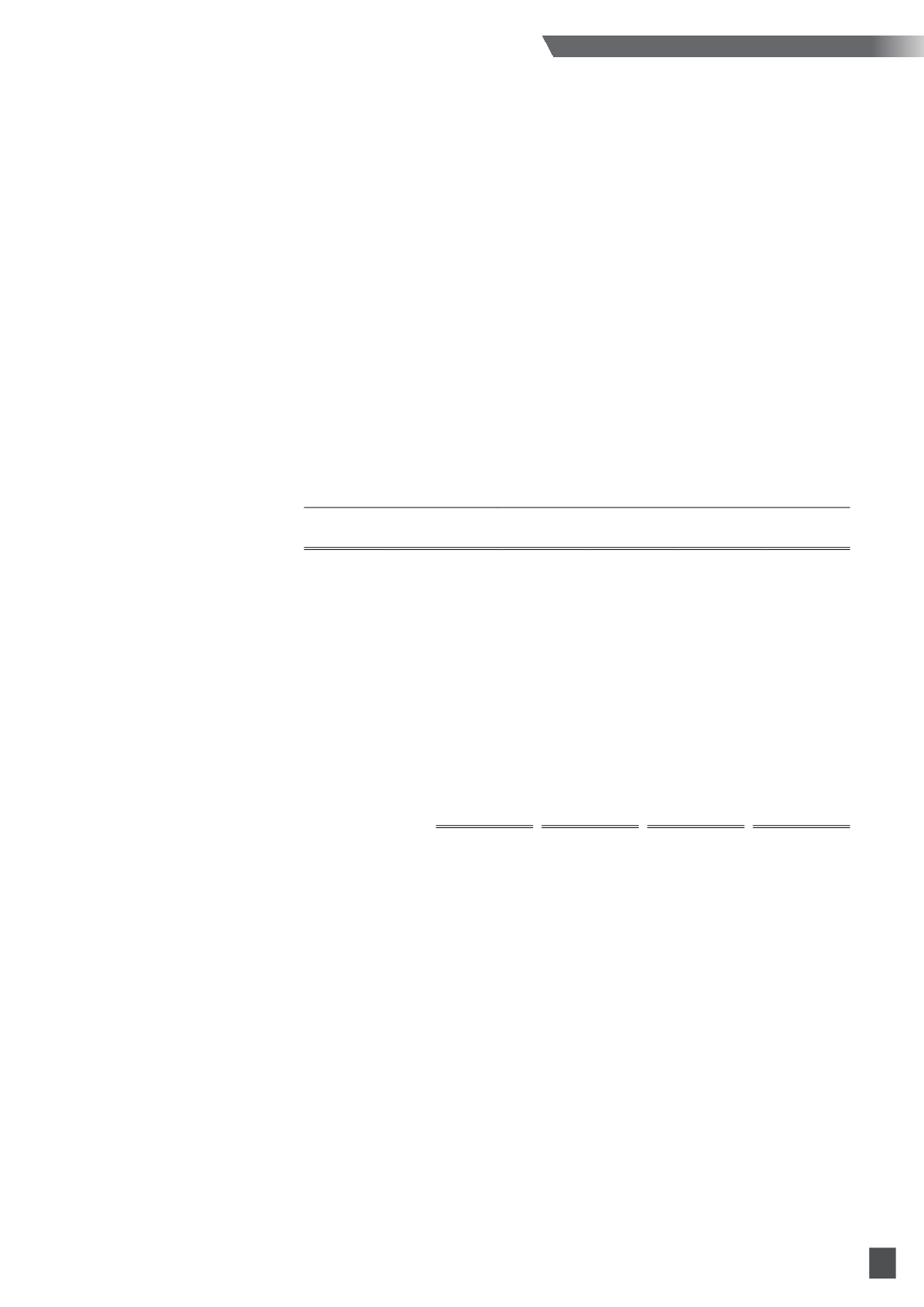

29. Share capital

Group and Company

Number of

shares

2015

Share

capital

2015

Number of

shares

2014

Share

capital

2014

’000

$’000

’000

$’000

Issued and fully paid:

At beginning and end of financial year

235,586

35,722

235,586

35,722

The holders of the ordinary shares are entitled to receive dividends as and when declared by the

Company. Each ordinary share carries one vote without restriction.The ordinary shares have no par value.

Unissued shares under share options as at 30 April 2015 comprise 750,000 (2014: 780,000) options entitling

holders to subscribe at any time during the exercise period for the same number of ordinary shares in

the Company at the exercise price of $0.43 (2014: $0.43) per share. The details of the share options are

discussed in Note 7.

The holders of the share options have no right to participate by virtue of these options in any share issue

of any other company in the Group.