Notes to the Financial Statements

(Cont’d)

For the year ended 30 April 2015

(In Singapore Dollars)

95

STAMFORD TYRES CORPORATION LIMITED

BUILDING ON OUR EXTENSIVE NETWORK

35. Financial risk management objectives and policies (cont’d)

(d)

Liquidity risk (cont’d)

1 year

or less

2 to 5

years

Over 5

years

Total

$’000

$’000

$’000

$’000

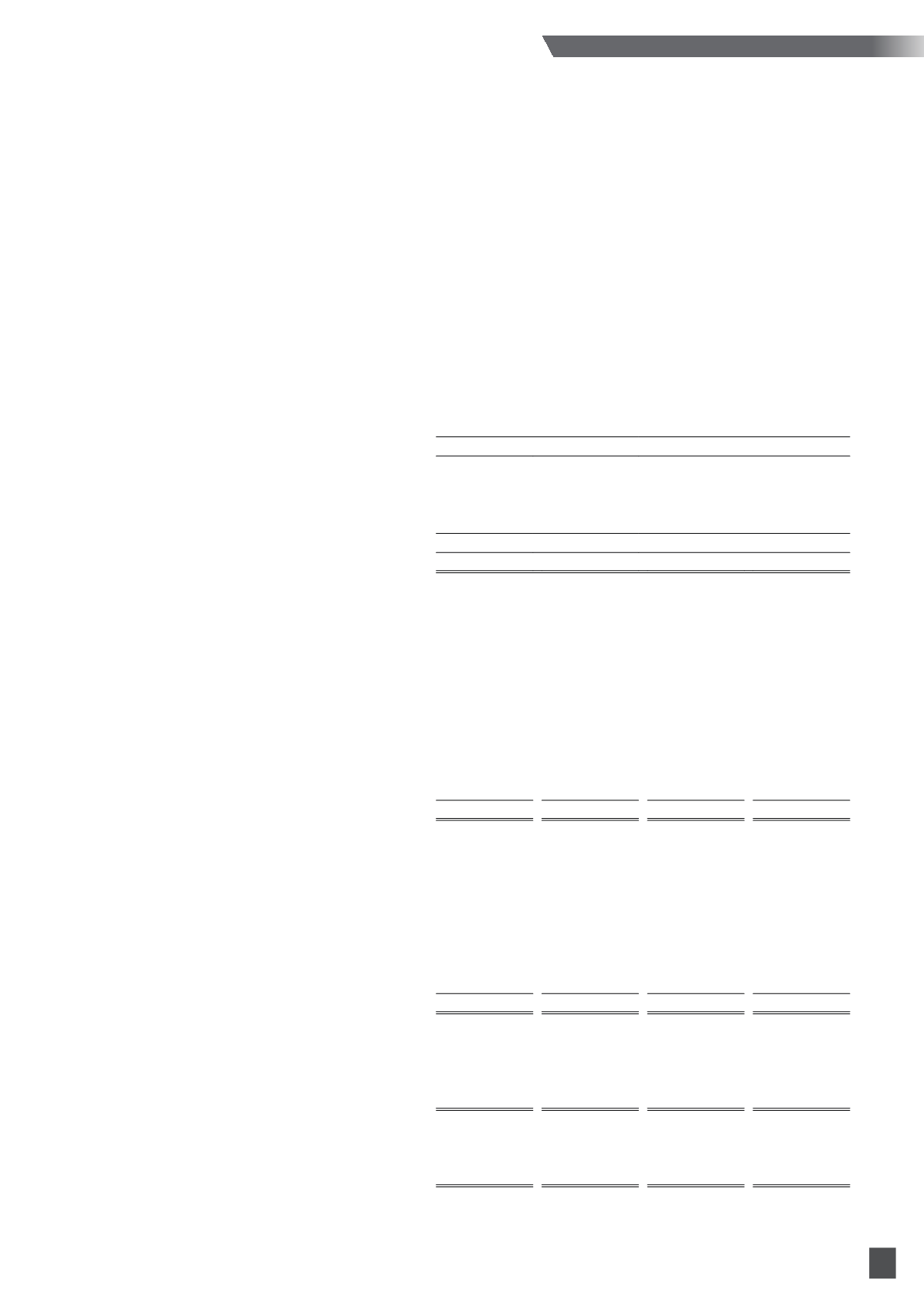

2014

Company

Financial assets

Other receivables

88

–

–

88

Cash and cash equivalents

1,714

–

–

1,714

Total undiscounted financial assets

1,802

–

–

1,802

Financial liabilities

Other payables

519

–

–

519

Derivatives

79

–

–

79

Total undiscounted financial liabilities

598

–

–

598

Total net undiscounted financial assets

1,204

–

–

1,204

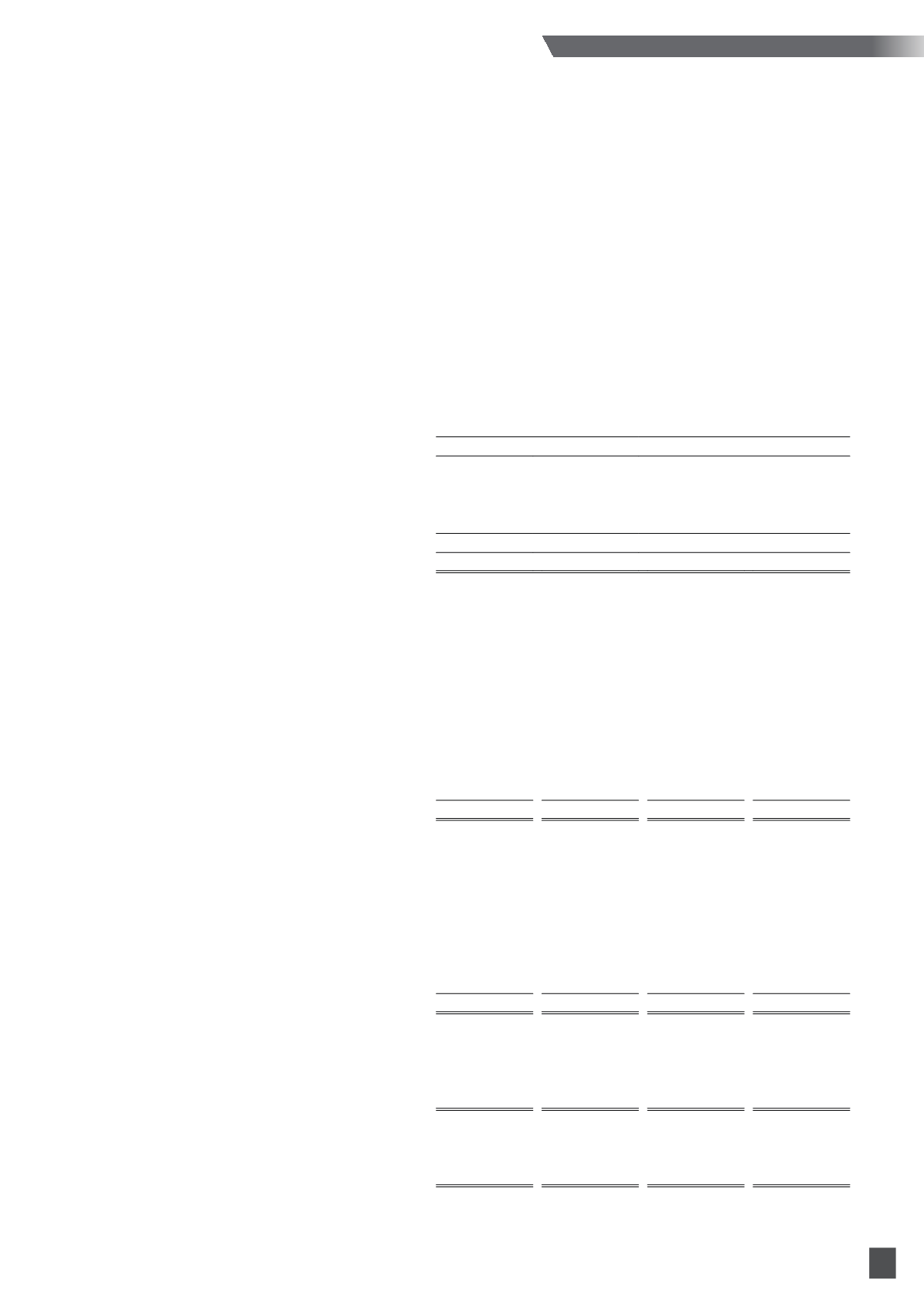

36. Classification of financial instruments

Group

Company

2015

2014

2015

2014

$’000

$’000

$’000

$’000

Loans and receivables

Trade receivables

78,861

74,601

–

–

Other receivables

3,160

4,041

91

88

Cash and cash equivalents

15,850

18,637

357

1,714

Amounts due from subsidiary companies

–

–

15,485

14,510

97,871

97,279

15,933

16,312

Financial liabilities measured at

amortised cost

Trade payables

17,244

22,319

–

–

Trust receipts (secured)

70,641

61,806

–

–

Other payables

18,249

20,752

612

519

Loans (secured)

56,904

52,907

–

–

Hire-purchase liabilities

3,280

1,580

–

–

Amounts due to subsidiary companies

–

–

12,362

5,881

166,318

159,364

12,974

6,400

Fair value through profit or loss

Forward currency contracts

- Derivatives assets

188

–

–

–

- Derivatives liabilities

(51)

(207)

(3)

(79)

Interest rate swap

- Derivatives assets

41

–

–

–

- Derivatives liabilities

(3)

(58)

–

–