Notes to the Financial Statements

(Cont’d)

For the year ended 30 April 2015

(In Singapore Dollars)

ANNUAL REPORT 2015

90

BUILDING ON OUR EXTENSIVE NETWORK

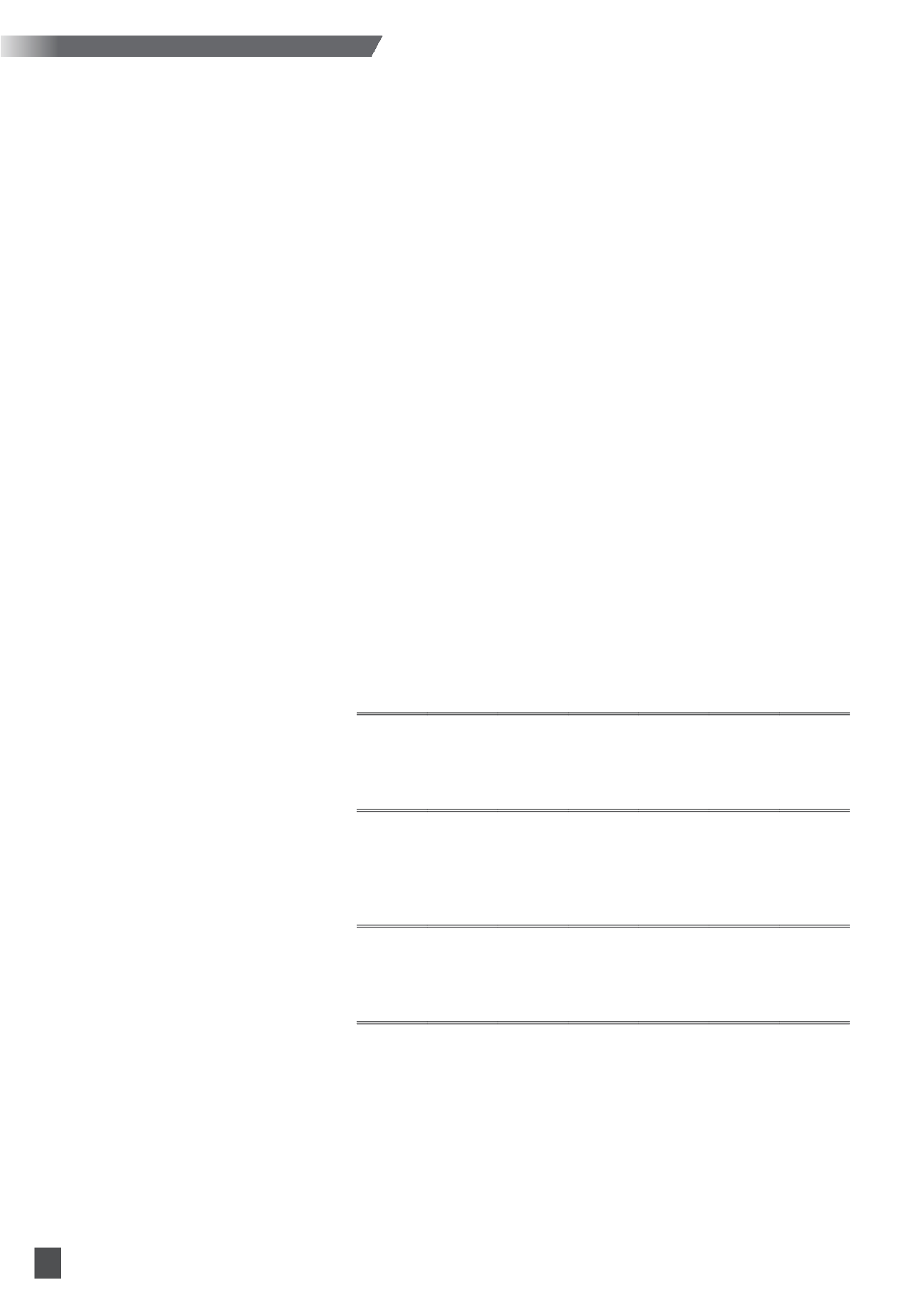

35. Financial risk management objectives and policies (cont’d)

(b)

Interest rate risk

Interest rate risk is the risk that changes in interest rates will have an adverse financial effect on the

Group’s financial conditions and/or results. The primary source of the Group’s interest rate risk is its

borrowings from banks and other financial institutions primarily in Singapore, Malaysia and Thailand.

The Group ensures that it obtains borrowings at competitive interest rates under the most favourable

terms and conditions. Where appropriate, the Group uses interest rate swaps to hedge its interest

rate exposure for specific underlying debt obligations. Risk variables are based on volatility in interest

rates. This analysis assumes that all other variables, in particular foreign currency rates and tax rates

remain constant. Information relating to the interest rate is disclosed in Notes 22, 24, 25 and 27. At

the end of the reporting period, approximately 10% (2014: 2%) of the Group’s borrowings are at

fixed rates of interest. Cash and bank balances are excluded from the table below as fluctuations of

interest rates are determined to have no significant impact on the Group’s profit net of tax. Included

in the table below are the Group’s interest-bearing financial instruments, categorised by the earlier

contractual re-pricing or maturity dates.

Group

Within 1

year

Within 1-2

years

Within 2-3

years

Within 3-4

years

Within 4-5

years

More than

5 years

Total

$’000

$’000

$’000

$’000

$’000

$’000

$’000

2015

Fixed rate

Derivatives assets

41

–

–

–

–

–

41

Derivatives liabilities

3

3

Obligations under hire-purchase 1,115

844

560

553

13

–

3,085

Bank loans

9,136

92

92

92

72

–

9,484

Floating rate

Obligations under hire-purchase

54

24

16

101

–

–

195

Trust receipts

70,641

–

–

–

–

–

70,641

Bank loans

13,060

4,632 14,795

2,177

2,142 10,614 47,420

2014

Fixed rate

Derivatives liabilities

58

–

–

–

–

–

58

Obligations under hire-purchase

681

372

119

86

78

–

1,336

Bank loans

91

111

111

111

60

–

484

Floating rate

Obligations under hire-purchase

94

82

41

27

–

–

244

Trust receipts

61,806

–

–

–

–

–

61,806

Bank loans

13,705

4,933

4,511 14,703

2,130 12,441 52,423